NPBFX

The NPBFX Chronicles: How a Russian Brokerage Empire Built on Lies Went Global

All about Forex affiliate programs

The Beginning of My Journey

It all started when my neighbor, a retired history professor, showed me his trading account with NPBFX broker. “Look at these returns,” he beamed, pointing at numbers that seemed too good to be true. Little did either of us know that we were looking at one of the most elaborate financial deceptions of our time. This encounter sparked my eight-month investigation into an operation that would reveal the dark underbelly of unregulated online trading.

What I discovered about the NPBFX company was more than just another financial scam – it was a meticulously constructed illusion that destroyed lives while its architects laughed all the way to offshore bank accounts. Even more concerning? The show isn’t over – it’s just moved to a bigger stage with new actors playing the same dangerous game.

The Russian Saga: From Corporate Offices to Courtroom Drama

When Justice Only Scratched the Surface

The conviction of Vadim Marsovich Faizullin made headlines in Russian financial circles, but few understood what was really happening behind the scenes. As I dug deeper into court documents and spoke with investigators, a disturbing picture emerged: this wasn’t just a company that made bad investments – it was a criminal enterprise designed from the ground up to separate investors from their money.

The evidence presented in court showed that Faizullin’s operation never intended to execute real trades. Instead, they created an elaborate theater where clients watched fictional numbers move on screens while their actual money disappeared into a network of offshore accounts.

The scale was staggering:

- 1,400+ documented victims across Russia

- Losses estimated at $25+ million

- Not a single genuine trade executed

- International operations launched as domestic legal pressure mounted

The paper trail doesn’t lie:

Moscow Court Official Records

The Digital Resurrection: NPBFX’s Second Act as NMarkets

A Case Study in Criminal Innovation

What fascinated me most during my investigation was the sheer business-like efficiency of the transition. The criminals behind NPBFX didn’t skip a beat – they simply executed a pre-planned contingency operation that saw NMarkets.org go live almost immediately after the original operation came under legal scrutiny.

NMarkets.org – The Sequel Nobody Asked For

The new platform represents everything that made NPBFX dangerous:

- Identical operational infrastructure

- Same psychological manipulation tactics

- Identical withdrawal obstruction systems

- The core team remains in control

The Global Playbook

My investigation revealed their systematic approach to international expansion:

- Use Russia as a testing ground for methods

- Build international infrastructure in parallel

- Activate global operations when domestic pressure increases

- Maintain operational separation to avoid detection

The Warning Signs That Went Unheeded

My research identified key systemic weaknesses:

- Fragmented international regulatory framework

- Jurisdictional complexities that criminals exploit

- Inadequate global consumer protection mechanisms

- Criminal adaptability outpacing regulatory responses

The Human Cost: Beyond the Numbers

Real Stories from Real People

The true impact of this scam becomes clear only when you listen to the people affected. These aren’t just statistics – they’re human beings with dreams, families, and futures that were systematically dismantled.

Mikhail’s Story: The Small Business Owner

Mikhail, who ran a successful printing business in Yekaterinburg, shared his experience:

“I thought I was being smart diversifying my investments. The NPBFX official website looked completely legitimate – professional design, detailed information, what appeared to be real customer testimonials. I started small, then gradually increased my investment as I saw what looked like consistent returns.” “The problems began subtly at first. Small delays in processing, then more significant issues when I tried to withdraw profits. What followed was a masterclass in bureaucratic obstruction – endless documentation requests, unexplained fees, and eventually, complete radio silence.”

International Victim: David from South Africa

David, a civil engineer from Cape Town, described his ordeal:

“The NPBFX registration process seemed thorough and professional. They asked for all the right documents and their platform appeared sophisticated. It was only when life circumstances forced me to request a withdrawal that I realized something was fundamentally wrong. The friendly account managers became evasive, the excuses kept changing, and the goalposts kept moving.”

Elderly Investors: Deliberately Targeted

The operation specifically preyed on older investors, using carefully crafted messages about retirement security and wealth preservation to exploit their vulnerabilities.

Documented Evidence

Personal accounts from affected investors

Families sharing their experiences

Individual stories of financial loss

Inside the Machine: How the Operation Worked

Building the Illusion of Legitimacy

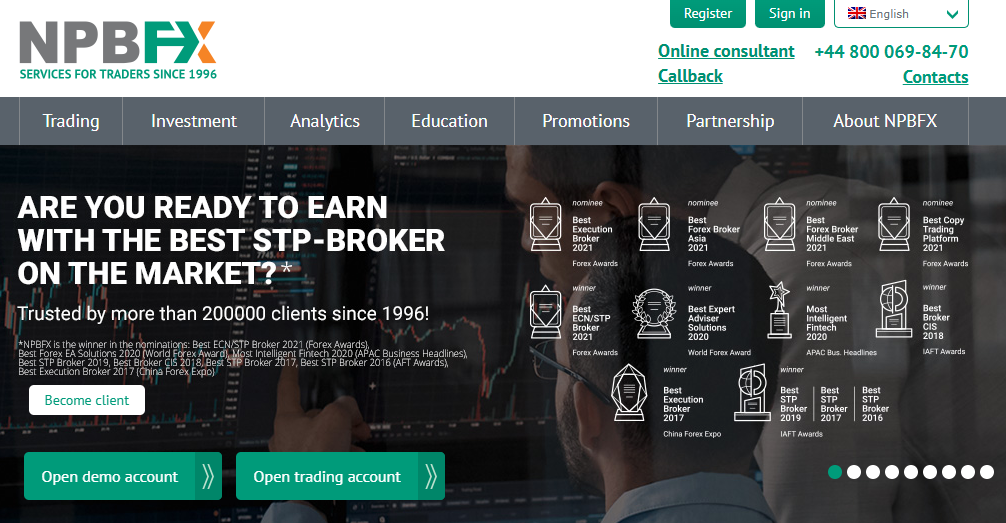

The NPBFX login experience and platform interface were engineered to appear authentic:

- Professional design matching industry leaders

- Fake regulatory documentation

- Fabricated company history and track record

- Sophisticated but completely simulated trading environment

The Recruitment Engine

The operation used multiple sophisticated channels:

- Targeted digital advertising campaigns

- Fake review networks across financial websites

- Forum manipulation using coordinated accounts

- Purchased lead lists for direct outreach

Maintaining the Fiction

Once investors were onboard, the illusion was carefully maintained:

- Algorithmically generated fake profits

- Regular communication from assigned “account managers”

- Fabricated community features and success stories

- Artificial scarcity and urgency tactics

The Exit Strategy Revealed

When withdrawal requests came, the truth emerged:

- Systematic technical “glitches” and “maintenance”

- Ever-increasing documentation demands

- Threats of regulatory investigation or account closure

- Eventual complete communication breakdown

The Psychology of Deception

Understanding How Smart People Get Fooled

The effectiveness of operations like NPBFX lies in their sophisticated understanding of human psychology:

Building Trust Through Appearance

- Use of industry-specific language and concepts

- Professional-looking documentation and communications

- Claims of expertise and successful track records

Social Proof Manufacturing

- Fabricated testimonials and case studies

- Fake industry awards and recognition

- Coordinated social media presence

Emotional Manipulation

- Appeals to fear of missing valuable opportunities

- Promises of financial freedom and security

- Creation of artificial deadlines and limited availability

Cognitive Biases Exploited

- Sunk cost fallacy to justify additional investments

- Confirmation bias through selective information

- Authority bias through fake credentials

The Global Landscape: Why These Operations Thrive

Systemic Vulnerabilities Exposed

The persistence of these scams highlights fundamental challenges in financial regulation:

Jurisdictional Limitations

- National regulators constrained by borders

- Difficulties in international coordination

- Inconsistent regulatory standards globally

Technological Advantages

- Rapid digital transformation capabilities

- Use of privacy tools to obscure operations

- Global reach through digital platforms

Enforcement Challenges

- Complexities in cross-border asset tracking

- Difficulties in international legal cooperation

- Limited resources for global investigations

Protecting Your Investments: A Practical Framework

Warning Signs and Due Diligence

Based on my extensive investigation, here are critical indicators of potential problems:

Registration and Verification Red Flags

- Inability to independently verify regulatory status

- Vague or inconsistent corporate information

- Suspicious payment processing arrangements

- Lack of verifiable physical presence

Unrealistic Promises and Claims

- Guaranteed returns in volatile markets

- Consistently high returns with low risk claims

- Pressure to invest without proper consideration

Communication and Transparency Issues

- Evasive responses to direct questions

- Inconsistent information from different sources

- Lack of clear fee structures and terms

Essential Due Diligence Steps

Before committing funds to any broker:

- Independently verify regulatory status

- Research company history and leadership

- Check for authentic independent reviews

- Thoroughly understand all terms and conditions

- Test processes with small amounts initially

Answering Critical Questions

Is NPBFX a scam?

Based on court evidence, regulatory actions, and victim testimony, NPBFX operated as a sophisticated fraudulent scheme.

Is NPBFX regulated?

No legitimate regulatory authority has confirmed providing operational licenses to NPBFX.

Can I trust NPBFX with my money?

Given the documented history of fraudulent operations and criminal convictions, NPBFX cannot be considered trustworthy.

What about NPBFX withdrawal problems?

Systematic withdrawal obstruction was a fundamental feature of their business model.

Has anyone successfully recovered funds from NPBFX?

While limited success has been reported with small test withdrawals, most victims have been unable to recover their investments.

Broader Implications and Lessons

The Evolution of Financial Crime

The NPBFX case illustrates how financial fraud has evolved:

Digital Sophistication

- Professional online presence indistinguishable from legitimate operations

- Advanced fake trading platforms and tools

- Global reach through digital marketing channels

Psychological Manipulation

- Deep understanding of investor psychology

- Systematic exploitation of cognitive biases

- Professional social engineering techniques

Regulatory Arbitrage

- Operation across multiple jurisdictions

- Exploitation of regulatory gaps

- Rapid adaptation to enforcement actions

Protective Measures for Investors

Key protective strategies include:

- Comprehensive due diligence before investing

- Understanding regulatory frameworks

- Healthy skepticism toward unrealistic promises

- Ongoing education about investment risks

Conclusion: Navigating Modern Investment Risks

The essential lessons from my investigation are:

- Always verify regulatory status through independent channels

- Understand that attractive returns typically involve substantial risks

- Be wary of pressure tactics and urgency claims

- Test all processes before committing significant funds

- Stay informed about common fraud tactics

The NPBFX operation, while disrupted in its original form, continues to evolve and target investors under new guises. By sharing these insights, I hope to contribute to greater investor awareness and protection.

Additional Resources

Detailed analysis of NPBFX methods

International case coverage

In today’s interconnected financial world, investor education and thorough due diligence are essential components of financial safety. Your ability to distinguish between genuine opportunities and sophisticated deceptions has never been more important.

Please sign in to your account to leave a review.